Q2 2025 Market Commentary

Market Overview 2Q25

The second quarter concluded much as it began—defined by persistent policy uncertainty, escalating trade tensions, and evolving macroeconomic risks. The U.S. economy remains on uneven footing, with tariffs and erratic policy actions under the Trump administration contributing to heightened uncertainty and weighing on business investment and consumer confidence.

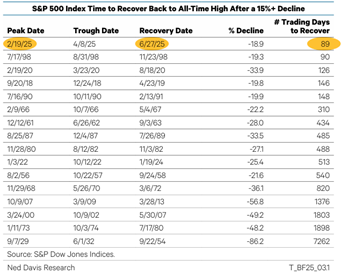

Despite this complex backdrop, equity markets staged a historic recovery. After a sharp -12.1% selloff triggered by sweeping tariff announcements on April 2nd, the S&P 500 rebounded with a +10.6% gain in Q2—its best quarterly performance since Q4 2023 and the fastest bounce back from a 15%+ drawdown on record. [1] Growth stocks led the advance as investor sentiment improved, the U.S. dollar weakened, and Treasury yields declined modestly. Year-to-date, the S&P 500 is now up +6.2%.

Global diversification proved advantageous in the first half of 2025. The MSCI ACWI ex-U.S. Index surged +12% in Q2 and is +18.3% year-to-date, significantly outperforming U.S. equities. International markets—particularly Europe, Emerging Markets, and China—benefited from a softer dollar, targeted stimulus efforts, improving manufacturing data, and strengthening global macro indicators.[2]

Meanwhile, the fixed income market delivered modest gains following a strong first quarter. The Bloomberg U.S. Aggregate Bond Index rose only +1.21% in Q2, as interest rate volatility remained elevated and expectations for Federal Reserve policy continued to evolve.[3]

Policy, Growth & Fed Outlook

Expectations for U.S. GDP growth in 2025 have been revised lower, with most forecasts now in the 1.4%–1.8% range, following a disappointing Q1 revision to -0.5% annualized. The contraction was driven by a historic drag from net exports and slowing final domestic demand.

While inflation remains contained for now, tariff passthrough effects are expected to accelerate in the second half, which could limit the Fed’s flexibility. Although the unemployment rate is stable at 4.1%, job growth has slowed, with June payroll gains concentrated in the public sector. In addition, wage growth has softened, reinforcing signs of potential cooling in the labor market.

Markets are currently pricing in two 25-basis-point rate cuts before year-end, which would bring the Fed Funds rate to 3.75%–4.00%. A potential policy shift could come as early as the September FOMC meeting, particularly if labor market data continues to weaken.

According to FactSet, S&P 500 earnings growth for 2025 is now projected at 9%, a step down from earlier double-digit expectations due to margin compression linked to tariffs. That said, strong corporate balance sheets and ongoing share buybacks continue to provide important support for equity markets.

Sentiment and Technicals

Investor sentiment was tested during the sharp early-April selloff but improved meaningfully as equities rebounded. Technical indicators strengthened into quarter-end, with broad market participation and accelerating inflows into equity funds signaling renewed investor confidence. Key market breadth indicators remain constructive, reflecting stronger earnings trends and easing concerns over immediate economic disruption.

By the end of Q2, markets appeared to distinguish between headline risks and longer-term fundamentals. However, the durability of the recovery will depend in part on how long tariffs remain in place, as prolonged trade tensions could weigh on business confidence and capital investment. Surveys from May and June showed meaningful declines in CEO confidence and manufacturing activity, underscoring the fragility of the current backdrop.

While August and September have historically been weaker months for equities, especially in post-election years, resilient earnings and strong breadth readings support the case for continued market resilience. Still, the path forward will likely be shaped by the clarity (or lack thereof) around U.S. trade and fiscal policy.

Positioning and Outlook

Staying the Course Amid Volatility

Historically, sharp short-term drawdowns have often created opportunities for stronger forward returns—and this quarter was no exception. Following the early Q2 market correction triggered by sweeping tariff announcements, we maintained our equity allocation and, in several cases, used the volatility as an opportunity to selectively rebalance portfolios: trimming outperforming bond positions and modestly increasing equity exposure where valuations became more attractive. As a result, we continue to maintain a marginal overweight to equities relative to our long-term strategic benchmarks.

Despite headwinds from policy uncertainty and a weakening U.S. dollar, we remain overweight U.S. equities, where we believe core long-term fundamentals remain intact. In fixed income, we continue to hold a modest overweight to duration—positioning portfolios to benefit from potentially lower yields should growth moderate, while also providing ballast during periods of market volatility.

Policy in Motion: Early Impact of the Trump Administration

The Trump administration’s renewed focus on domestic manufacturing and economic revitalization is already influencing the policy landscape. Several major initiatives have advanced, each with important implications for markets and portfolio positioning:

Fiscal Policy & Monetary Easing:

In early July, Congress passed the “One Big Beautiful Bill,” a sweeping fiscal package that includes broad tax cuts and targeted spending designed to spur domestic growth. At the same time, slower economic data has increased the probability of Federal Reserve rate cuts later this year.Tax Cuts Extended and Expanded:

Key provisions of the 2017 Tax Cuts and Jobs Act (TCJA) have been made permanent, including individual tax relief and enhanced capital expenditure deductions. These reforms aim to support consumer demand and business investment.Tariffs Reinstated and Expanded:

A 10% universal tariff is now in effect on most imports, with additional duties of up to 50% on select categories such as metals, electronics, and pharmaceuticals. While intended to bolster domestic industry, these measures introduce new risks for supply chains, margins, and inflation.Deregulation in Motion:

The administration has begun rolling back select environmental and business regulations, with a focus on energy, financial services, and manufacturing. While the near-term impact has been modest, recent corporate investment announcements suggest early momentum is forming.

What This Means for Investors

These early policy changes have reintroduced volatility into markets—but they also create potential tailwinds for U.S. growth, particularly if monetary easing follows. That said, elevated policy risk, trade tensions, and potential inflationary pressures remain key themes to monitor.

Looking ahead, market direction will likely hinge on how long these trade measures remain in place and whether greater clarity emerges around economic and foreign policy. The Federal Reserve’s anticipated rate path could provide further support if growth slows further.

Our approach remains rooted in discipline, diversification, and data-driven decision-making. Rather than reacting to headlines, we remain focused on long-term fundamentals and avoiding emotional decision-making amid short-term noise. In our view, long-term investors are best served by staying the course, using volatility to their advantage, and ensuring portfolios remain aligned with individual goals.

As always, we welcome your questions and look forward to discussing how this evolving environment may impact your portfolio.

DISCLOSURES

IMPORTANT DISCLOSURE INFORMATION

This material is provided for information purposes only and should not be construed as a recommendation or investment advice, as the material does not consider the investment objectives, risk tolerance, restrictions, liquidity needs or other characteristics of any one particular investor. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Please note that nothing in this content should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing is intended to be, and you should not consider anything to be direct investment, accounting, tax or legal advice to any one investor. Consult with an accountant or attorney regarding individual accounting, tax or legal advice. No advice may be rendered unless a client service agreement is in place.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any benchmark. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss.

New World Advisors, LLC ("New World") is a Registered Investment Advisor ("RIA") with the U.S. Securities and Exchange Commission (“SEC”). New World provides investment advisory and related services to clients nationally. New World will maintain all applicable notice filings, registrations and licenses as required by the SEC and various state regulators in which New World conducts business. New World renders individualized responses to persons in a particular state only after complying with all regulatory requirements or pursuant to an applicable state exemption or exclusion.

[1] Morningstar Direct & Ned Davis Research

[2] Morningstar Direct

[3] Morningstar Direct