Q2 2022 Market Overview

Market Recap

The first half of 2022 has been an unusually difficult period for investors as both stocks and bonds sustained material declines. The S&P 500 plunged -16.5% for the second quarter and -20.6% for the year-to-date, marking the worst start since 1970 and the fourth worst on record.[i] Bonds suffered their largest decline in over 40 years and the traditional safe-haven characteristics were absent as the Bloomberg Barclays U.S. Aggregate Bond Index fell -10.4% for the first half of the year.[ii] Global stocks were not immune as the MSCI ACWI dropped -20.2% for the first six months.[iii]

The highest inflation reading in recent memory is the focal point for corporations, consumers, and the Federal Reserve. All eyes remain fixated on the Fed, which is attempting to orchestrate a “soft landing” by balancing an environment of historically low unemployment on one side with the highest level of inflation in four decades on the other. Inflation has proven to be less transitory than the Fed had hoped, forcing it to pursue the most aggressive monetary tightening cycle in nearly 30 years. By hiking interest rates by 1.50% this year, the Fed is constraining financial conditions with the goal of suppressing demand to bring inflation back to target.

This has translated into an environment of heightened uncertainty. The daily market gyrations this year reflect a lack of clarity, confidence, and conviction in the outlook for global economic growth and corporate earnings. As the level of uncertainty remains elevated, it is difficult to believe the stock market will sustain any meaningful upside traction in the near term. We expect we will need at least a couple of months of improving data points for the markets to gain confidence that these overhangs are turning.

In recognition of this environment, we reduced risk across client portfolios during the quarter for the second time this year by selling stocks and buying bonds. Our asset allocation framework dictated that we further reduce risk to a more defensive posture as the market continues to digest a transition period of slowing economic growth and sticky inflation.

While doom and gloom headlines are prevalent, several positive data points do exist. Though moderating, GDP growth is still expected to remain positive, consumers have exited the pandemic with strong balance sheets, unemployment is hovering at near record lows, and businesses are still reinvesting. Furthermore, consumer spending has remained resilient in the face of rising inflation, which is a welcomed sign given that it represents more than two-thirds of the U.S. economy. Investor sentiment is beginning to approach a level of pessimism that could be viewed as a positive for markets, at least in the near term. The next few months will no doubt be pivotal for the economy and stock market as monetary policy uncertainty and inflation readings garner headlines.

Not surprisingly, the indicators we monitor overall show no indication that the volatility will abate. Therefore, we expect the uncertainty and volatility to persist as the second half of the year unfolds. While we noted that not all is dire, the data increasingly confirms that the U.S. economy is slowing, and the risk of mild recession has certainly increased as a result. Overall, the weight of the evidence of our asset allocation framework guides us to a defensive posture as we enter the second half of the year; however, we remain eager to increase equity exposure as the environment improves.

Historical Context

We believe it is imperative not to let fear wreak havoc on your long-term investment strategy. Unpleasant periods of volatility often lead to a behavioral or emotional response that causes investors to abandon their long-term focus. We are all influenced by a behavioral bias called loss aversion to some degree. It is the perception that the pain of losing is disproportionately greater than the pleasure of gaining, because our brain is hardwired to magnify the pain of lose. Adhering to a disciplined asset allocation process is essential during market pullbacks. Rather than act on emotion, it is important to have a structure in place to quantify the current environment. This enables one to make objective decisions based upon history and what the environment may portend.

While no one can forecast the future, we can provide some historical context for the recent market decline. Looking at the 8 times the S&P 500 fell at least 15% in a single quarter since World War II, the following quarter was positive 88% of the time by an average of 6.2%, according to Ned Davis Research.

While that statistic may be encouraging, it is worth noting that the deeper the stock market decline, the longer the recovery period. Historically, most market pullbacks have registered declines under 20%. Since World War II, the S&P 500 has registered 28 declines of 10% to 20%, and it has taken only 4 months, on average, to recoup the losses. The recovery extended to 14 months, on average, following the 10 bear markets (declines of 20% to 40%) during that same period.[iv] While severe pullbacks have typically been accompanied by a recession, pullbacks in general should not undermine a well-diversified, long-term portfolio.

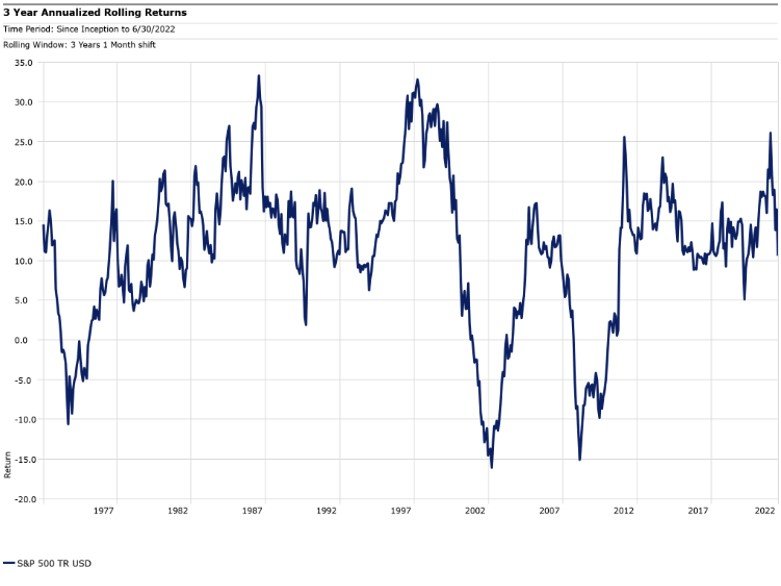

Lastly, the chart below highlights the three-year rolling return for the S&P 500 since 1970. Except for the 2000-2002 dot.com bubble and the 2007-2008 financial crisis, the three-year rolling return has generally been above zero. As of quarter end, the three-year annualized return was 10.1%, which is in line with the long-term historical average of 10.7%.[v]

We understand the first half of the year has not been easy to stomach and managing emotions in the current environment can be difficult. While each economic environment is unique, the data above provides some historical context for the importance of staying disciplined and focused on the long-term view. We appreciate your trust during these uncomfortable times and look forward to the brighter days that lie ahead. As always, please never hesitate to reach out to us with any questions.

[i] Morningstar Direct

[ii] Morningstar Direct

[iii] Morningstar Direct

[iv] Guggenheim Investments

[v] Morningstar Direct – Long term historical since Jan. 1970

Disclosures:

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any benchmark. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss.

New World Advisors, LLC ("New World") is a Registered Investment Advisor ("RIA") with the U.S. Securities and Exchange Commission (“SEC”). New World provides investment advisory and related services to clients nationally. New World will maintain all applicable notice filings, registrations and licenses as required by the SEC and various state regulators in which New World conducts business. New World renders individualized responses to persons in a particular state only after complying with all regulatory requirements or pursuant to an applicable state exemption or exclusion.