How Does Private Equity Perform in a Recession?

Investment banks and economists on Wall Street have been warning about an impending recession for some time now. In fact, as of this writing, the S&P 500 Index is retesting the June lows, and everything financial pundit on television is trying to determine whether global recession risk has been appropriately “priced in”. Perhaps a better use of time could be educating ourselves on where pockets of opportunity exist.

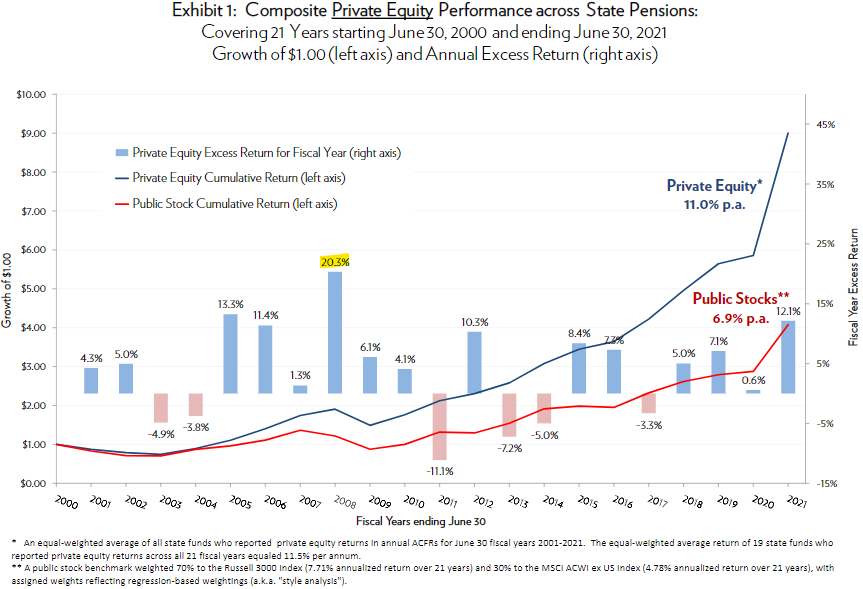

Never considered a “port in the storm”, private equity is often characterized as an asset class which carries a high amount of risk, and high return potential. Deductive reasoning would tell you the asset class should perform poorly during a recession. The reality is actually quite different. If we look back over the 21-year period ending on June 30, 2021, the market was broadly characterized by two bear markets (2001-2003 and 2008-2009), and two bull markets (2004 – 2007 and 2010 - 2019). Over that period, the private equity asset class outperformed during bear markets and underperformed only in years where public equities were up 10% or more[i]. In fact, the most meaningful amount of relative outperformance came in 2008, which was the worst year for stocks during the period (blue bar chart, below)[ii].

How does a “high risk, high return” asset class deliver such strong results in a down market? Though each environment is unique, there are a few characteristics of the asset class which provide an advantage when times get tough. Looking at the economic environment today, it may be worthwhile to keep these top of mind.

How Do Private Equity Strategies Outperform in a Recession?

1. Long-Term Focus

Private equity strategies often have a longer holding period than public market strategies, which promotes a more patient, active investment strategy. This comes in handy in two ways. First, PE groups can be proactive in making new investments at attractive terms when an industry encounters economic distress. Second, while executives of existing portfolio companies are laser focused on making sure their businesses are running smoothly, PE groups can provide strategic guidance on whether acquisitions or reinvestment into high returning projects makes sense. The ability to think objectively about the long term in a challenging environment is incredibly valuable. In fact, some of the strongest returns in private equity came from Funds raised in years associated with an economic downturn (chart below) [iii].

2. Hands-On Approach Managing Portfolio Companies.

Any private equity group worth partnering with has a deep bench of operational talent which can help a business pivot during a downturn. Those groups have historically offered advice and resources to help guide a company through any strategic shifts, while also using their networks to assist in renegotiating loan terms or other liabilities to alleviate financing concerns (chart below). In fact, according to a Harvard University study, PE backed companies invested 6% more and gained 8% of market share versus their non-PE backed peers during the Global Financial Crisis [iii]. Beyond that, in the years immediately following the GFC, loans to PE Backed companies were about 50% more likely to be renegotiated than those to non-PE backed companies[iii]. This type of proactive management at the portfolio company level should result in a stronger, better capitalized company which is ultimately more attractive for an acquirer. Once again, the proof is in the numbers, according to the same Harvard study, PE-backed companies were 30% more likely to be acquired in the post-GFC period than non-PE backed companies[iii].

3. Ability to Capitalize on Illiquidity.

Though this may seem contradictory, private equity’s illiquid structure provides one major advantage to investors during a distressed period. The structure of PE funds prevents any panic selling in the depths of a downturn. By keeping the decision-making power in the hands of professional investors who are closest to the asset, private equity groups naturally hedge the risk of fire sales across their portfolio [iv]. Rather than selling winners to meet redemptions, private equity strategies can wait patiently for market conditions to improve before selling an asset.

This is not meant to say that private equity strategies will always perform well in a downturn, or that private equity investing should be considered “less risky” than public markets. What we are saying is there are inherent attributes of private equity investing - a long term focus, active involvement in portfolio companies, and a fund structure that protects investors from emotional decisions – which can help these groups turn hard times into opportunities.

Sources:

i) Cliffwater: “Long-Term Private Equity Performance: 2000 to 2021” Stephen L. Nesbitt, June 2022

ii) NEPC: “Market Chatter: Investing in Private Markest, from Recession to Recovery”, Hanson, Harnish, Mendenhall, July 2020

iii) iCapital: “Private Equity Offers Resilience in a Downturn”, Veronis & Esipovich, August 2020

iv) Gridline, “Private Market Performance in Recessions”, Gridline Team, May 2022

Disclosures:

An investment in private funds or companies involves significant risks and is suitable only for those investors who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the private fund or company will achieve its investment objective. An investment in private funds carries with it the inherent risks associated with the underlying investments in the funds. The information provided is for informational and educational purposes only and is not intended to constitute as a solicitation of an offer. Only certain qualified investors can consider a commitment and should carefully review all relevant offering documents before investing in any private fund or company.

This document is for your private and confidential use only, and not intended for broad usage or dissemination. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

New World Advisors, LLC ("New World") is a Registered Investment Advisor ("RIA") with the U.S. Securities and Exchange Commission (“SEC”). New World provides investment advisory and related services to clients nationally. New World will maintain all applicable notice filings, registrations and licenses as required by the SEC and various state regulators in which New World conducts business. New World renders individualized responses to persons in a particular state only after complying with all regulatory requirements or pursuant to an applicable state exemption or exclusion.