Q3 2022 Market Overview

Market Recap

After a tumultuous summer for the capital markets, the S&P 500 Index finished the third quarter down -4.9%, and remains firmly in the red, declining -23.9% for the year-to-date period.[1] Global stocks as measured by the MSCI ACWI index were harder hit, declining -6.8%, which was exacerbated by the headwinds of significant US dollar appreciation.[2] The S&P 500 proceeded to rally for the first half of the summer only to enter a down trend on the heels of the Federal Reserve’s annual Jackson Hole Economic Symposium in August. During the symposium, Fed Chair Powell emphasized that the Fed would need to see substantial evidence of lower inflation to dial back its current hawkishness.

Now the cautionary story is well telegraphed. All roads lead to inflation and the monetary policy path of the Federal Reserve. This further captured the spotlight with the unexpectedly elevated Consumer Price Index (CPI) data for August, which saw the core goods component accelerate month-over-month. Durable goods, such as autos and household furnishings also rose, confirming the consumer remains in good shape. The troubling component was shelter inflation, the largest component of inflation, which rose .7% month-over-month, the highest monthly increase since 1991.[3]

In response, the Fed has now hiked interest rates further and faster than at any time in modern history by raising its benchmark federal-funds rate to a target range of 3% to 3.25% by quarter end. As a result, borrowing costs have now risen to the highest level since Q1 2008. Adhering to the committee’s dual mandate of price stability and full employment, Powell reiterated that the Fed is prepared to push the economy into a recession, if necessary, to bring inflation under control. This appears to be an effort to brace investors for a tighter-for-longer monetary environment.

In addition to raising its key interest rate target, the Fed began reducing its nearly $9 trillion balance sheet in June and picked up the pace in September. The process known as quantitative tightening (QT) is intended to reduce the amount of liquidity in the banking system with the goal of raising borrowing cost and ultimately slowing economic growth. The program is likely to be spread out over several years, as the Fed has not defined a set period or balance sheet level. The takeaway is that monetary policy has dramatically shifted from easing to tightening with the goal of stifling demand and the pace of economic growth.

As a result, the bond market continued to be historically hard hit, declining in unison with equities as interest rates rose. To provide historical context, this is the only year in history in which the S&P 500 and US 10-year Treasury Bond have declined more than 10%. Year-to-date the bellwether US 10-year Treasury has declined a staggering -16.7%.[4] Therefore, traditional bond allocations have not provided their historical defensive or ballast characteristics. Furthermore, as the chart below illustrates, this is the worst start to the year for a traditional balanced portfolio since 1974, declining over -20%.

The seemingly unrelenting upward movement in interest rates has been particularly distressing for more conservative investors who are far less accustomed to experiencing double digit declines. As the chart below illustrates, this has been the most severe drawdown decline for the bond market in over 40 years. While the path to this point has been painful, looking forward, the time to recover losses on average has been just over 5 months. The positive aspect is that bonds are far more compelling today than they have been in years.

Current Positioning

We enter the fourth quarter with the asset allocation indicators we monitor showing no near-term indication that the volatility will abate. While the landscape began to improve in mid-July, it did not provide the confirmation necessary to increase equity exposure in client portfolios. Therefore, the weight of the evidence of our asset allocation framework has remained defensive after having reduced the risk profile of portfolios twice this year by selling equities.

In this environment, we are particularly focused on the Technical and Investor Sentiment factors that we monitor, which reflect how the market is acting in the near-term. Technical Market Factors are measuring the collective decisions of millions of investors and their opinions regarding the macroeconomic environment. These factors have remained poor for most of the year as the trend for global markets has been volatile and directionally down. While the collection of technical market factors exhibited some strength during the first part of the quarter, it quickly reversed in the second half.

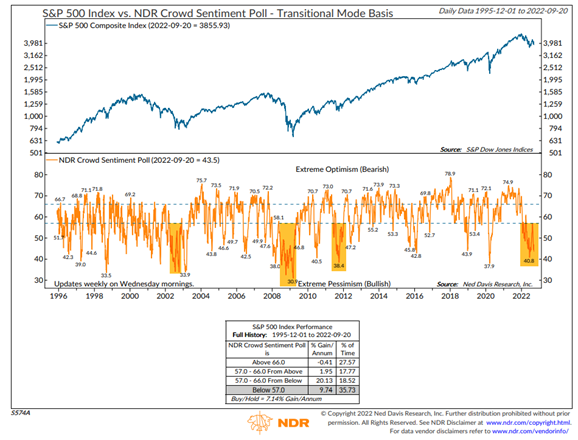

Investor Sentiment is historically a contrarian indicator, particularly at extremes. Cautionary refrains brought on by elevated inflation and a hawkish Fed has soured investors’ mood for much of the year. Given the increased risks of an economic recession and a corporate earnings slide, the tendency is for investor pessimism to continue to increase. Thankfully, history tells us that nothing lasts forever, and this too shall pass. As the chart below illustrates, we are in the midst of the third-longest stretch of extreme pessimism for a broad array of investors since 1995. Historically, some of the best times to invest have been when it is the most uncomfortable to do so.

As a result, we eagerly await the opportunity to increase equity exposure when our framework confirms evidence of an improving environment. Until that point, we remain defensive and disciplined. While we do not know where the market is headed in the near term, the subsequent performance after similar historical declines is compelling. As illustrated in the table below, on average the market is materially higher a year or more later after similar declines.

Therefore, it is essential to not alter your investment time horizon unless your financial goals have changed. While no one is clairvoyant and can accurately predict when exactly the environment will turn, it is important to reiterate that this will not last indefinitely. Our process is not intended to “time-the-bottom”, but rather is focused on leaning your portfolio more aggressive when our asset allocation framework identifies the environment as historically attractive and leaning more conservative when it is less favorable.

We know over the years that selling after major declines is likely to convert temporary volatility into the permanent loss of capital. Therefore, it is imperative to stay disciplined, be patient, and avoid altering your long-term plan. We are cognizant that this environment has been unsettling, particularly for new clients. We appreciate and do not take for granted the trust you place in us. As always, we are here to review and discuss in more detail.

Disclosures:

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any benchmark. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss.

New World Advisors, LLC ("New World") is a Registered Investment Advisor ("RIA") with the U.S. Securities and Exchange Commission (“SEC”). New World provides investment advisory and related services to clients nationally. New World will maintain all applicable notice filings, registrations and licenses as required by the SEC and various state regulators in which New World conducts business. New World renders individualized responses to persons in a particular state only after complying with all regulatory requirements or pursuant to an applicable state exemption or exclusion.

[1] Morningstar Direct

[2] Morningstar Direct

[3] US Bureau of Labor Statistics

[4] Morningstar Direct