So Long 2022, Hello 2023!

Before drawing the curtain on the worst year for equities since 2008(1), we thought it was an appropriate time to review the most noteworthy market related stories that occurred during the year and offer a few points investors should be optimistic about headed into 2023. There was a lot to cover this year, and a lot to be excited about, so apologies in advance if we missed anything you were hoping to see.

We hope you and your families have a safe, enjoyable time ringing in the New Year, and are looking forward to a successful 2023! See you next year!

Top Stories From 2022:

1) Highest Inflation in Four Decades

The biggest story of 2022 by far. Zero interest rate policy (“ZIRP”), supply chain woes, war, chip shortages, Covid shutdowns, etc. all helped fuel the steepest climb in prices since the early 80s(2). Bear in mind, the Fed didn’t begin hiking until March when CPI was up 8.5% year over year.

2) Fastest Fed Hiking Campaign in Modern History

After showing up late to the party, the Fed was forced to play catch up. The FOMC imposed 425 bps of fed funds rate increases from March through December. Folks, we are all operating inside of the most aggressive monetary policy experiment in recent history.

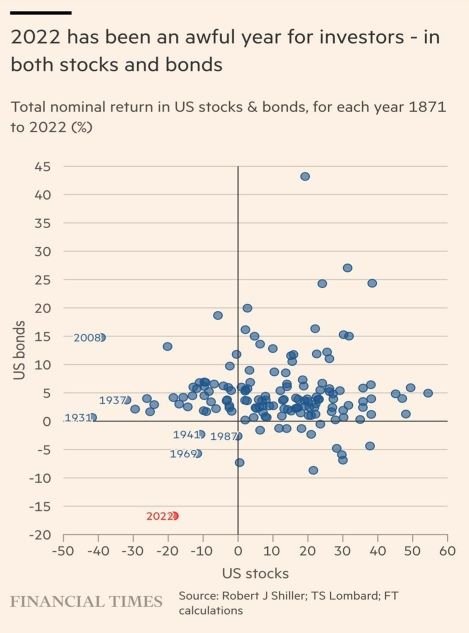

3) Losses in both Stocks and Bonds for the First Time Since Late 60’s

Thanks to the shocking rise in rates, it appears that for the first time since 1969 we’re going to have both stocks and bonds down over the course of a calendar year(3). This has happened only three times since 1929, 2022 will be the fourth. For those who are diversified across both asset classes, the 60/40 portfolio is on pace to record the worst returns since 2008(4).

4) Housing Affordability Hit a 35-year low

Surging interest rates led to decades-high mortgage rates. Those rates were imposed on an incredibly hot housing market, and not surprisingly, affordability fell to its lowest levels in 35 years(5). According to Andy Walden at Black Knight, Inc., the last time affordability was this low was in the mid-1980’s when 30-year rates were at 12.9%(6)!

5) The War in Ukraine

Vladimir Putin invaded Ukraine to thwart an advance from NATO and its allies. As a result of the Russian aggression, supply chains grinded to a halt, commodity prices surged, Russian markets closed for trading, and their economy was heavily sanctioned by the West. If you thought de-globalization was just a passing fad after the Covid shutdowns, this added rocket fuel to the fire.

6) Ponzi Schemes

As if the investing environment in 2022 wasn’t challenging enough for crypto, Sam Bankman-Fried’s (“SBF”) FTX blew up after their main competitor unloaded his FTT coin. This set off a margin call of sorts which wound up exposing the largest Ponzi scheme since Bernie Madoff. The entire crypto complex sold off as investors grappled with the fallout from what was once the world’s third largest crypto exchange. Perhaps a candidate for the quote of the year, SBF is “deeply sorry” that he took money from depositors and used it for his own wellbeing.

7) Consumer Optimism Hit an All-Time Low

It should not come as a surprise that the University of Michigan’s Consumer Confidence index registered an all-time low this year, as well as eight consecutive months below a reading of 60. That’s the longest run of extreme pessimism going back to 1952, when the data began being collected(7). The previous record was four straight months during the 1980 recession(8).

Despite these headwinds, the S&P 500 was down only 20%, with a peak to trough decline of 25%. Now that we’ve reviewed some of the negatives that transpired during 2022, let’s discuss a few reasons investors can be optimistic headed into 2023.

Reasons to Be Optimistic about 2023:

1) When Stocks are this Beaten Down, Future Returns Look Good

During 2022, the peak to trough drawdown was just above 25%. Looking back over time, forward returns when markets are this beaten up are very strong, and certainly well above the average. Going back to 1950, in only one observation following a 25% drawdown were the markets lower one year later. In the majority of cases, markets are higher by an average of 16.7% in the subsequent twelve months(9).

2) Savers are being Paid Again

For the first time in a long time, savers are being paid again! Across Charles Schwab’s money market funds, yields are hovering in the mid 3s to low 4s(10). Looking across NerdWallet’s “Standout Savings Accounts” the yields are approximately the same. To put that into context, investors can now get more interest from an FDIC insured account than they could have in September 2021 loaning money to a high yield (i.e., “risky”) issuer.

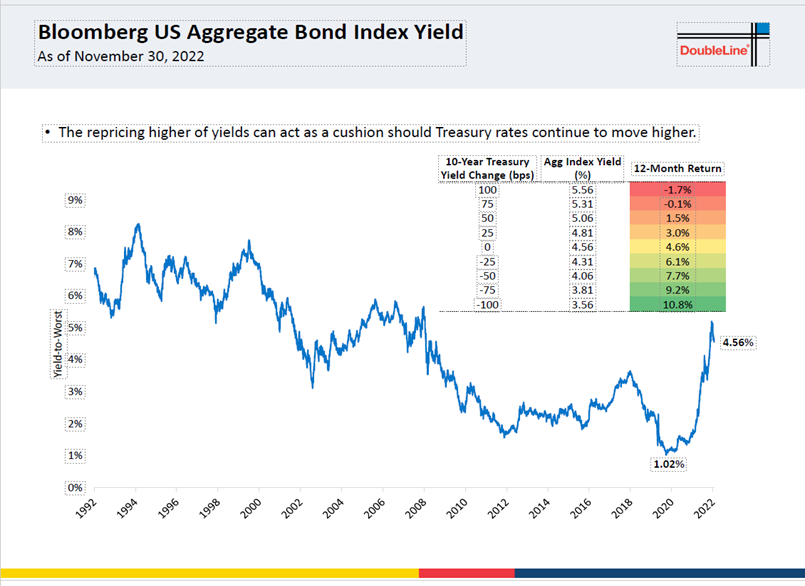

3) Bonds are Playing a Role Again

Bonds have regained some of their defensive characteristics as the cushion from higher yields is now offsetting any increases in interest rates. A higher yield helps to protect a portfolio’s total return by generating greater income for the lender. If interest rates go up, bond prices may come down, but the higher yield being generated will allow investors to recoup that loss quicker thanks to greater levels of income. This is a monumental change from 2021, and from the zero-interest rate policy (ZIRP) we’ve been living with since the GFC (Global Financial Crisis).

4) The Fed Hiking Cycle Expected to Wrap up in May

After the most aggressive tightening efforts in the modern monetary policy era (see above), the Fed may be ending their rate hiking campaign by May of 2023 (currently expected by Goldman Sachs, as of 12/14/22). The range of outcomes has narrowed dramatically since the beginning of 2022, and uncertainty surrounding future monetary policy will continue to abate as we near the expected terminal rate.

5) Inflation is Finally Turning Over

Finally, at long last, the surge in inflation is slowing. Transitory categories seem to have made the turn, and we’ve gone from an annual run rate of more than 9% to around 7%. While it isn’t prudent to declare the “all clear”, it feels as though the Fed’s efforts are working and we’re headed in the right direction.

There is no doubt that 2023 will bring its own challenges with it as every year does, and no one knows with certainty how 2023 will transpire. In fact, as of this writing, the spread between the highest and lowest Wall Street forecast for where the S&P 500 will finish out 2023 is 1,000 points (between 4,400 and 5,400). That’s more than 25% of the S&P 500’s worth today, at around 3,900. What can you do with that?

What we do know for sure is we went through a lot in 2022, and there are some positives to focus on headed into 2023. We hope you and your families have a wonderful time ringing in the New Year, we look forward to a successful 2023! Happy New Year!

Sources:

(1) Morningstar Data; Referenced Index: S&P 500

(2) Bloomberg: “US Inflation Quickens to 40-Year High, Pressuring Fed & Biden”, Rockeman, June 2022

(3) BlackRock: “Rebuilding Resilience in 60/40 Portfolios”, 2022. Stocks: S&P 500, Bonds: 10-Year Treasuries from 1929 to 1976 and the Barclays US Aggregate from 1976 to 2002

(4) Compound Advisors: “This week in Charts (12/20/2022)”, Bilello, December 2022

(5) Black Knight, Inc.: “Home Affordability Hits 35-Year Low”, Walden, June 2022

(6) Black Knight, Inc.: “Home Affordability Hits 35-Year Low”, Walden, June 2022

(7) Compound Advisors: “This week in Charts (12/20/2022)”, Bilello, December 2022

(8) Compound Advisors: “This week in Charts (12/20/2022)”, Bilello, December 2022

(9) A wealth of Common Sense: “Bear Market Opportunities…”, Carlson, October 2022

(10) Charles Schwab & Co.: Money Market Yields as of 12/27/2022