Q4 2022 Market Commentary

A year in the rear-view mirror…

2022 Market Recap

We entered 2022 anticipating that market volatility would persist, and cognizant that the Federal Reserve’s accommodative policy was shifting. Consensus expectations were for a few gradual rate hikes during the year aimed at combating stubbornly high inflation. What came as an utter surprise to market participants was the rapid ascent of interest rates, which took the Fed Funds rate from 0% at the beginning of the year to an eye-popping 4.50% by December. The unprecedented pace of rate hikes during 2022 weighed heavily on asset valuations and investor risk appetite given the potential disruptions and instabilities brought on by such rapid tightening. Geopolitical outbreaks clouded the macro picture with Russia’s invasion of Ukraine in February and China’s renewed zero-COVID policy, which further exasperated supply chains weakened by the pandemic and stoked the flames of inflation.

As a result, global equity markets contracted, ending a three year stretch of positive returns, with the S&P 500 and MSCI ACWI finishing down -18.13% and -17.96% respectively for the year.[1] The tech heavy NASDAQ fared even worse, declining an astounding -32.51% for the year, and underperforming the value-titled Dow Jones Industrial Average by the widest margin since the dotcom bubble burst in 2000.[2]

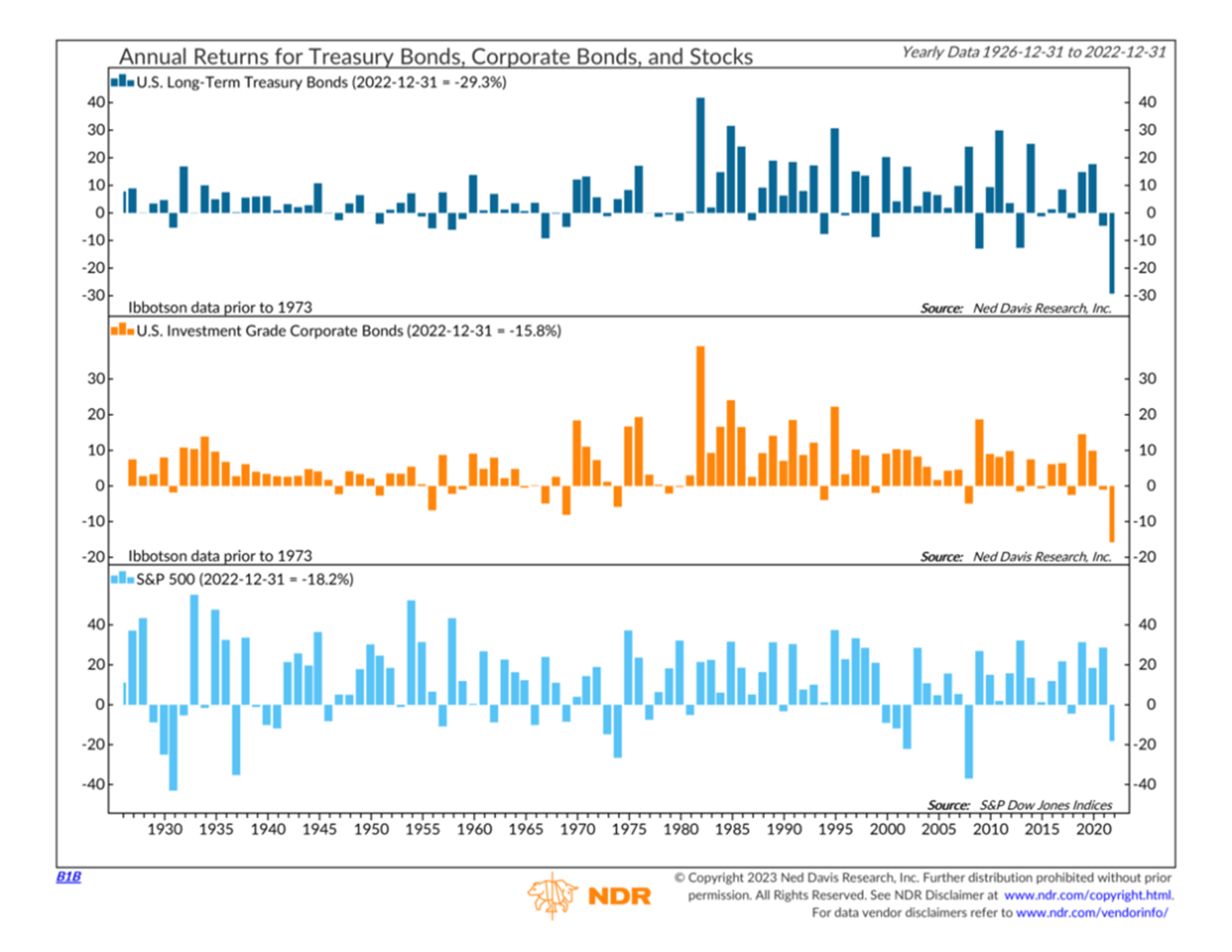

2022 was a year for the history books, and one that bond investors would like to forget, as the highest inflation and most aggressive monetary tightening cycle in 40 years translated into the worst year on record for the Bloomberg Barclays U.S. Aggregate Index, down -13.0%.[3] The longer the duration, the worse the return. Long-Term U.S. Treasurys Bonds fared the worst, plunging a staggering -29.3%.[4] As you see in the chart below, no other year has been in the same stratosphere. Investment grade corporate bonds were not immune, tumbling a record -15.8%.[5]

The chart below summarizes why 2022 was such a unique year. While bonds, and certainly stocks, have bad years, it was only the fifth time since 1926 that both stocks and bonds declined in the same year, and the first time they both fell by over 10%.

While it was a year driven by interest rates, several multi-year trends reversed in 2022. T-bill and money market yields rose to their highest level since 2007. Large-cap value stocks beat large-cap growth stocks by the widest margin since the dotcom bubble burst in 2000. Despite the best year for the U.S. dollar since 2015, the U.S. underperformed the MSCI ACWI by the most since 2005.

Looking beneath the surface, 2022 brought bouts of double-digit market selloffs, followed by failed market rallies. As the chart below highlights, volatility was characterized by several multi-week swings. According to Ned Davis Research, the S&P 500 endured eight corrections of at least 5% during 2022, which is more than double the average of 3.4 and ties 2020 and 1974 for the most since the 1930s, excluding the Global Financial Crisis (GFC) of 2008.

Positioning for 2023

We turn the page to 2023 with the asset allocation indicators we monitor showing a modest improvement in the overall investment landscape. While the trailing economic data may worsen, history suggests the stock market bottoms close to peak inflation readings and ahead of the Fed Reserve’s final rate hike. The probability of a recession has increased, but if we do, we expect it to be relatively shallow in depth and duration. As we have noted before, the underpinnings of the U.S. economy remain solid, highlighted by the consumer, which accounts for nearly 70% of U.S. GDP. This environment is not like the 2008 GFC period of heavy indebtedness and contagion fears. The stock and bond markets have anticipated a great deal of macro headwinds likely to unfold during 2023.

We remain keenly focused on the Technical and Investor Sentiment factors that we monitor, which reflect how the market is trending in the near term. Technical Market Factors were improving overall during the fourth quarter and the trend for global markets remained volatile, but directionally positive. While the collection of technical market factors exhibited strength during the first part of the fourth quarter, it reversed during December, leading to a renewed bout of volatility to conclude the year.

A slew of concerns has led to the second-longest stretch of pessimistic Investor Sentiment. As the chart below highlights, outside of the GFC, this is the longest period of extreme pessimism in almost 30 years. While no single measure of sentiment is infallible the duration of pessimism can aid in identifying a potential market bottom. As we have noted before, some of the best times to invest have been when it is the most uncomfortable to do so.

Economic Factors are likely to continue to trend downward, with the U.S. economy teetering on the verge of a mild recession as the impact of the higher inflation and interest rates are felt. The Fed’s goal of bringing employment back into balance is showing minor signs of improvement. However, many of the employment challenges appear structural as the labor participation rate (percentage of the population that is working or looking for a job) has been declining since 2000 and has yet to get back to pre-COVID levels. Therefore, there is a limit to the labor softening we may see going forward as diminished immigration and an aging population cap the unemployment rate that hovers near a 50-year low.

Global Market Fundamentals experienced a significant reset across all asset classes over the past year. Global equity valuations appear much more attractive than a year ago with many areas presenting compelling long-term opportunities. The silver lining from the sharp rise in interest rates is that now, U.S. bonds are the most attractive they have been in years. Furthermore, given the starting point for interest rates in 2023, the historical ballast and diversification of bonds should resume. While valuation alone is a difficult market timing tool, volatility over the coming year is likely to lessen as inflation continues to recede and the Fed ends its aggressive tightening.

In summary, we enter the year defensively positioned relative to our strategic global benchmarks with an underweight to stocks. However, given the improving investment landscape noted earlier, we eagerly await the opportunity to increase stock exposure when our framework confirms evidence of a sustained, improving environment. While a mild U.S. recession may be in the cards, the stock and bond markets have anticipated a great deal of macro headwinds that lie ahead. During the year we should see the end of the Federal Reserve tightening cycle, inflation gradually falling, and the diversification benefits from a diversified stock/bond portfolio reemerge.

As the new year is underway, we thank you for your partnership and for entrusting us as the steward of your family’s wealth. We look forward to brighter days and seeing you soon!

DISCLOSURES

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any benchmark. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss.

New World Advisors, LLC ("New World") is a Registered Investment Advisor ("RIA") with the U.S. Securities and Exchange Commission (“SEC”). New World provides investment advisory and related services to clients nationally. New World will maintain all applicable notice filings, registrations and licenses as required by the SEC and various state regulators in which New World conducts business. New World renders individualized responses to persons in a particular state only after complying with all regulatory requirements or pursuant to an applicable state exemption or exclusion.

[1] Morningstar Direct

[2] Morningstar Direct

[3] Morningstar Direct

[4] Ned Davis Research

[5] Ned Davis Research